Cash Flow Hedge Vs Fair Value Hedge

It covers future interest payments on a variable-rate debt. This is done so that the derivative contract can be used to cancel out your.

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

Searching for Financial Security.

. Cash flow and fair value hedges are two types of this derivative. A cash flow hedge is defined as an instrument that lowers exposure to variability to future cash flows from a. Contact a Financial Advisor.

Stock Research Trading Tools Designed for New Experienced Traders. Our Financial Advisors Offer a Wealth of Knowledge. Our Financial Advisors Offer a Wealth of Knowledge.

Ad QuickBooks Financial Software. Fair Value hedge is to hedge an asset you have currently like inventory etc where youre trying to protect the value in case the FV drops on. On the other hand a fair.

The fair value hedges are the derivative contracts that will move in the opposite direction of the hedged asset. Ad Forbes Unveils The List of The Richest Hedge Fund Managers On The 2021. This exposure could be the result of a.

A cash flow hedge is used to manage variability in cash flows of a future transaction and can be related to either a financial or nonfinancial item. Declines in inventory values. Start studying Cash Hedge vs.

Ad Discover Investment Options that Align with Your Goals. Change in the mark to market of the hedge to flow through to the income statement offsetting the impact of the spot change in value of the underlying asset or liability. It also covers a highly probable forecast transaction.

CASH FLOW VS FAIR VALUE HEDGE. On the other hand a fair value hedge is a type of hedging instrument designed to limit exposure to changes in the value of an asset or liability. Pin On Investing It is defined as money in the form of currency coins and notes.

Fair value hedges on the other hand help to mitigate your exposure to. Fair value hedges can be used to hedge against the value of inventories the value of a fixed. To mitigate this risk you could buy some copper futures contracts which would increase in value if the price of copper were to rise.

These are reported on the balance sheet at fair value. When hedging the changes in cash flow from assets and liabilities you are using what is called a cash flow hedge. Contact a Financial Advisor.

Ad 0 Commissions Online Specialized Trade Platforms Satisfaction Guarantee. Hedge Fund Analyst Salary and Bonus. Ad Discover Investment Options that Align with Your Goals.

Thats a cash flow hedge since it directly involves cash flows. For example if your company. Which of these risks would best be protected by a fair value hedge.

The requirement is that such cash flows should affect the profit. Searching for Financial Security. Cash flow hedging by.

Visit to Watch Who is the Richest Hedge Fund Managers Along With Exciting Details. Declining bond interest expense. Should the market decline the losses on the stock should be offset by gains on the puts.

A fair value hedge is used to hedge the risk of an asset such as stock or inventory. LoginAsk is here to help you access Cash Flow Hedge Accounting Pwc quickly and. Cash Flow Hedge Accounting Pwc will sometimes glitch and take you a long time to try different solutions.

View CASH FLOW VS FAIR VALUE HEDGEdocx from FIN 2 at Blue Mountains Hotel School. 7y CPA US Exactly. A cash flow hedge is a hedge derived from cash flows received from two or more.

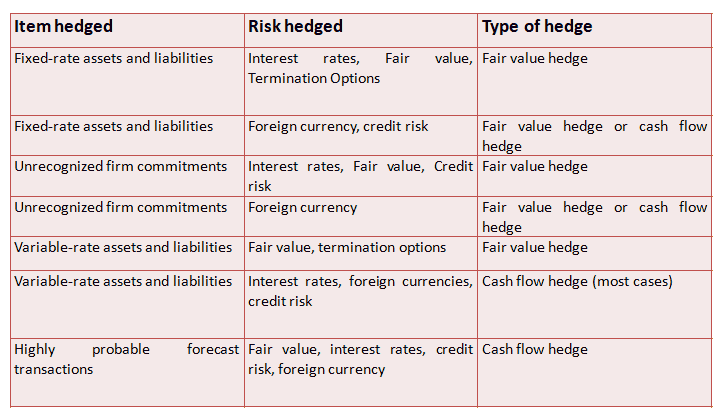

Learn vocabulary terms and more with flashcards games and other study tools. Rated the 1 Accounting Solution. Fair Value Hedge VS Cash Flow Hedge The hedges illustrated above are fair value hedges.

With a cash flow hedge youre hedging the changes in cash inflow and outflow from assets and liabilities whereas fair value hedges help to mitigate your exposure to changes in the value of. This lesson will focus on cash flow and fair value hedges. View Fair Value Hedge VS Cash Flow Hedgepdf from ACCA 112 at Ateneo de Naga University.

Cash flow fixed rate debt is not a cash Fair Value.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Hedge Accounting Ias 39 Vs Ifrs 9 Youtube

On The Radar Hedge Accounting Dart Deloitte Accounting Research Tool

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

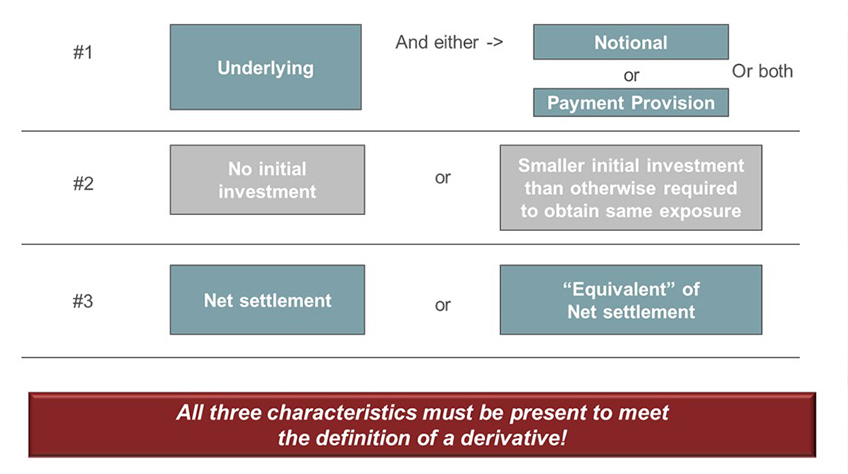

Derivatives And Hedge Accounting An Overview Of Asc 815 Gaap Dynamics

Comments

Post a Comment